A Case Study Based on Interviews

After interviewing Ag Aviation Operators, we identified key challenges and practical solutions. Here’s an abstract featuring Dan, an experienced aerial spraying operator based in Des Moines, Iowa, in the heart of the U.S. Corn Belt.

Every summer, Dan’s operation goes into overdrive, especially during the narrow window for spraying fungicides. For weeks, he flies daily, completing as many as ten runs before sundown. It’s a grueling but profitable season—until it’s not.

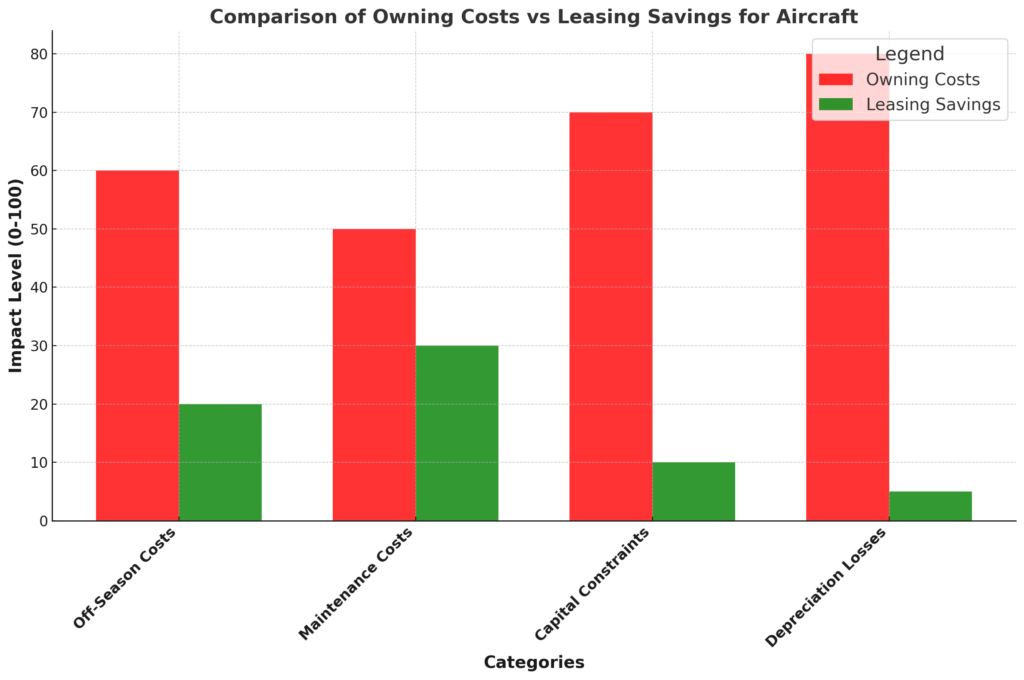

Dan’s Challenges with Owning His Aircraft

Dan owns his aircraft, a significant investment that provides flexibility but also brings major challenges:

- Off-Season Costs

After peak season, Dan’s aircraft sits grounded in the hangar, depreciating in value and accumulating storage and maintenance costs without generating revenue.

“An aircraft on the ground is a liability,” Dan often says, feeling stuck with these expenses. - Maintenance Headaches

To keep his aircraft airworthy, Dan invests time and money in inspections, repairs, and parts replacements. These unpredictable costs cut into his profit margin and distract him from other business priorities. - Capital Constraints

The large upfront investment to purchase the aircraft limits Dan’s ability to invest in other areas, such as marketing or adopting more efficient technologies.

He realizes too late that tying up capital in a depreciating asset wasn’t the best financial move.

The Cost of Depreciation and Lost Revenue

Dan’s aircraft costs $1.2 million, and it depreciates at roughly 10% annually—a loss of $120,000 each year. Over five years, that’s $600,000 in lost value, whether the plane is flying or not.

The idle months further compound the problem, leaving Dan with missed opportunities to generate revenue. For Dan, owning the aircraft feels like a catch-22: essential for business but a financial drain when idle.

Why Leasing Makes Sense

Now imagine if Dan had chosen to lease his aircraft instead. Here’s how leasing could transform his business:

- Lower Upfront Costs

Leasing avoids the hefty upfront capital investment. Dan would pay predictable monthly lease fees, freeing up cash for other priorities. - Flexibility During Peak Season

Dan could lease the aircraft for the specific months he needs it—like the spraying season—and return it afterward. This eliminates the burden of idle assets in the off-season. - Maintenance and Support Included

Many leasing agreements include maintenance services, reducing Dan’s financial and operational stress. He could focus on flying and growing his business. - Avoiding Depreciation Losses

With leasing, Dan wouldn’t have to worry about his aircraft losing value. He pays only for usage during its most profitable period.

Flying Smarter: How Leasing Aircraft Can Transform Aerial Spraying Operations

By leasing, operators like Dan can focus on their core business while avoiding the financial and logistical challenges of ownership. Leasing offers the flexibility, cost savings, and support that aerial spraying businesses need to thrive.